United States: Arm, the British company known for designing microchips, has submitted paperwork to sell its shares in the United States. This move could potentially lead to the largest stock market debut of the year.

According to reports, the company based in Cambridge aims to generate as much as $10 billion (£8 billion) from the sale. In March 2023 the company dealt a setback to the UK by announcing its lack of intention to list its shares in London.

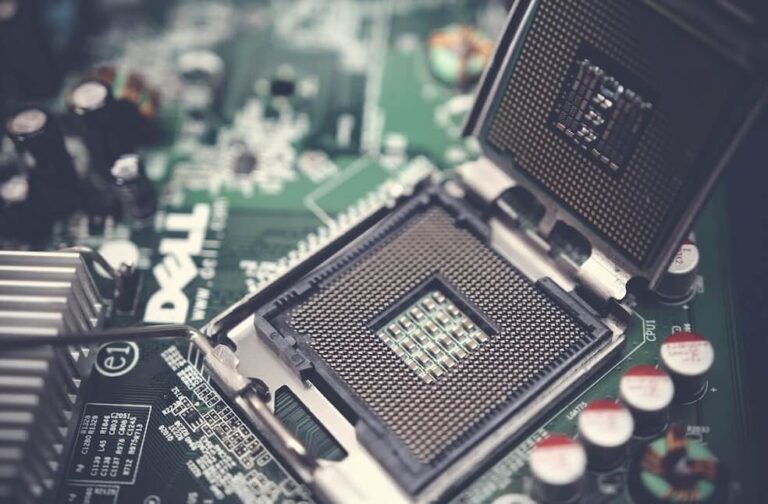

In a deal valued at $29.3 billion, Japanese conglomerate Softbank acquired Arm in 2016, when the company was listed on the London and New York stock exchanges. Arm specializes in designing the technology that forms the basis of processors, also referred to as chips, that are used to operate a range of devices such as smartphones and game consoles.

Companies such as Taiwan Semiconductor Manufacturing Company, Apple, and Samsung utilize Arm’s designs to manufacture their own processors. Softbank has announced that it has submitted a preliminary registration statement, confidentially, to the US Securities and Exchange Commission (SEC) for the purpose of the listing.

No details regarding the amount of funds to be raised or the timeline for the share sale were disclosed in the announcement. Reports suggest that the company aimed to generate anywhere between $8 billion to $10 billion through its listing on the technology-focused Nasdaq exchange in New York this year.

When a company is listed on a stock exchange, it transitions from being a privately-owned entity to a public company. This enables investors to trade shares of the company’s stock on designated exchanges. Arm’s choice to exclude London as an option for its listing has sparked worries that the UK market may not be doing enough to entice technology companies to go public, as US exchanges are perceived to provide more favourable profiles and valuations.

However, Softbank’s submission of the registration statement demonstrates its determination to proceed with the multi-billion dollar sale despite challenging conditions in global financial markets. In the aftermath of Russia’s incursion into Ukraine, the number of stock market listings has significantly decreased, and the pandemic has led to a decline in shares of major technology firms.