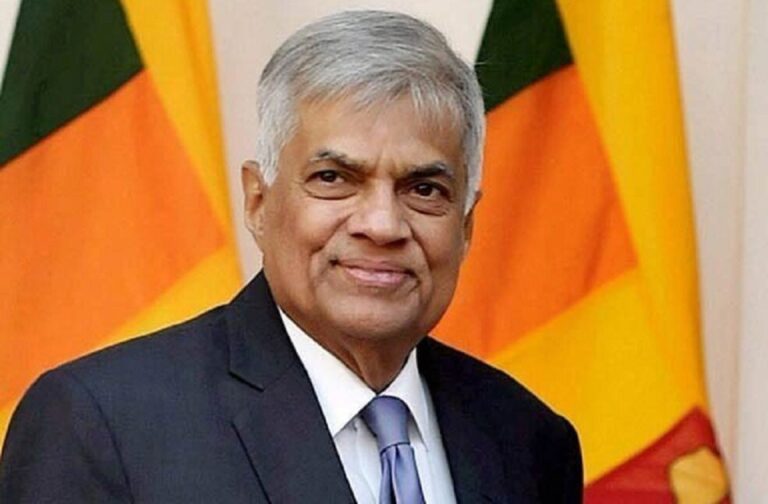

Sri Lanka: According to Sri Lanka’s president, the IMF will provide its final approval for the island nation’s $2.9 billion loan in the third or fourth week of this month. Mr. Ranil Wickremesinghe informed the legislature that all funding needs had been satisfied thanks to China’s renewed support.

The 22 million-person South Asian country is experiencing its biggest economic crisis since gaining independence from Britain in 1948. Last April, it stopped making payments on its $46 billion foreign debt, leading to months of nationwide food and fuel shortages.

The IMF agreement was essential so that other creditors could start releasing money, according to Mr. Wickremesinghe, who claimed that while there were signs the economy was improving, the country still did not have enough foreign currency to cover all of its imports.

To comply with the conditions of the IMF bailout, Wickremesinghe’s administration has increased taxes significantly, stopped providing subsidies for gasoline and electricity, and announced plans to sell off state businesses that are losing money. The Export-Import Bank of China gave Sri Lanka a two-year debt moratorium in January 2023 and stated that it would support Sri Lanka’s efforts to obtain the IMF loan, but a Sri Lankan source claimed at the time that this was insufficient to satisfy IMF requirements.

The two largest lenders to Sri Lanka are China and India. According to IMF data, Sri Lanka owes China’s Exim Bank $2.83 billion by the end of 2020, or 3.5 percent of the island’s foreign debt. The two largest lenders to Sri Lanka are China and India. According to IMF data, Sri Lanka owes China’s Exim Bank $2.83 billion by the end of 2020, or 3.5 percent of the island’s foreign debt.